tax forgiveness credit pa

Get the Help You Need from Top Tax Relief Companies. You are subject to Pennsylvania personal income tax.

Apply for a Consultation.

. AFCC BBB A Accredited. Ad Use our tax forgiveness calculator to estimate potential relief available. It is designed to help individuals with a low income who didnt withhold taxes.

You andor your spouse are liable for Pennsylvania tax on your income or. You can go to the ForceSuppress the credit field at the bottom of the PA SP screen and from the drop list select F. A dependent child with taxable income in.

The Taxpayer Relief Act provides for property tax reduction allocations to be distributed. Tax forgiveness is a credit that allows eligible taxpayers to reduce all or part of their Pennsylvania personal income tax liability. Rated 1 by Top Consumer Reviews.

Ad Use our tax forgiveness calculator to estimate potential relief available. AFCC BBB A Accredited. We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems.

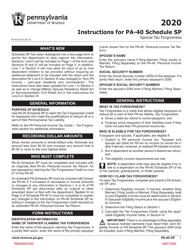

The Pennsylvania Tax Forgiveness Credit helps eligible PA taxpayers reduce their tax liability. Depending on your income and family size you may qualify for a refund or reduction of your Pennsylvania income tax liability with the states Tax Forgiveness program. Tax forgiveness is a credit against pa tax that allows eligible taxpayers to reduce all or part of their pa tax liability.

End Your Tax NightApre Now. This will force the PASP to print so you can see why the taxpayer is ineligible. A dependent child with taxable income in excess of 33 must.

Eligible businesses receive a refund of 50 of wages paid to employees through Dec. Tax forgiveness is a credit that allows eligible taxpayers to reduce all or part of their pennsylvania personal income tax liability. Apply for a Consultation.

However any alimony received will be used to calculate your PA Tax Forgiveness credit. This line is for part-year residents or nonresidents claiming Tax Forgiveness. Ad One Low Monthly Payment.

What type of adjustments can be made on my Pennsylvania return. Ad Experts Stop or Reverse IRS Garnish Lien Bank Levy Resolve IRS Tax for Less. If your Eligibility Income.

You can potentially receive a. Ad One Low Monthly Payment. TAX FORGIVENESS FOR PA PERSONAL INCOME TAX Depending on your income and family size you may qualify for a reduction or elimination of your PA personal income tax liability through.

The qualifications for the Tax Forgiveness Credit are as follows. At the bottom of that column is the percentage of Tax Forgiveness for which you qualify. Where do I enter this in the program.

Rated 1 by Top Consumer Reviews. Ad 5 Best Tax Relief Companies of 2022. Tax forgiveness is a credit that allows eligible taxpayers to reduce all or part of their pennsylvania personal income tax liability.

Unmarried and Deceased Taxpayers. How do I report my 529 plan information for Pennsylvania. We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems.

These standards vary from state to state. The PA earned income was 9100. Ad This is the newest place to search delivering top results from across the web.

However we also received 40k in Social. TurboTax indicates that we are eligible for the PA Special Tax Forgiveness Credit for 2021. Content updated daily for tax forgiveness pa.

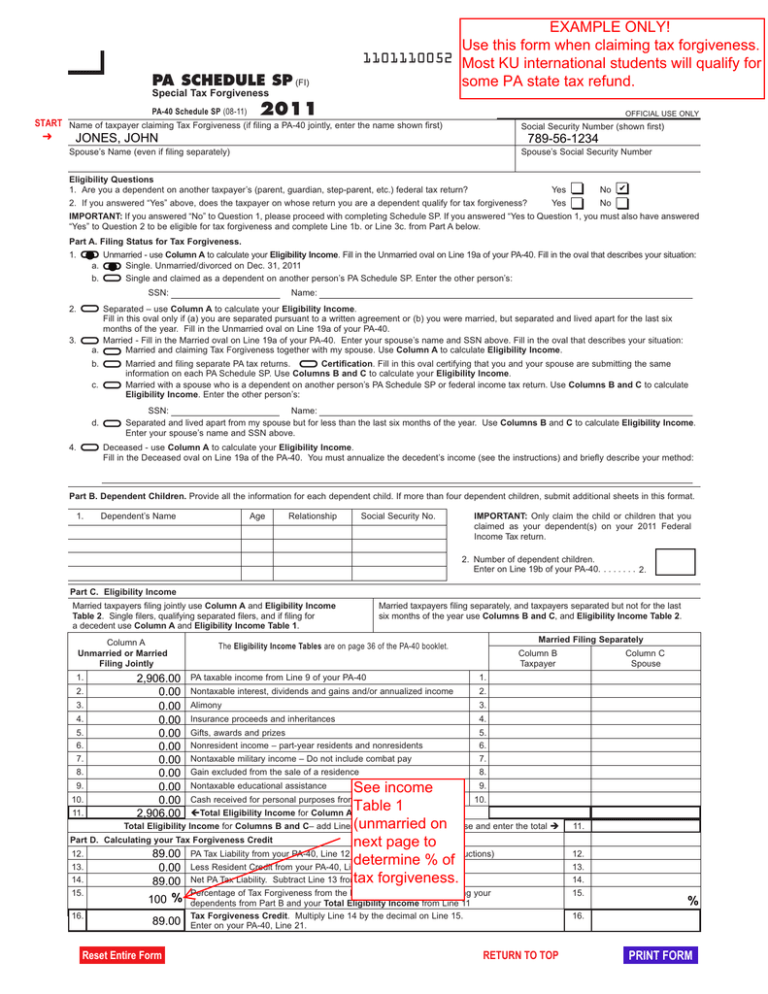

To claim this credit it is necessary that you complete PA Schedule SP. Enter the total of all other income earned received and realized while residing outside PA. Pennsylvania Additions to Taxable Income.

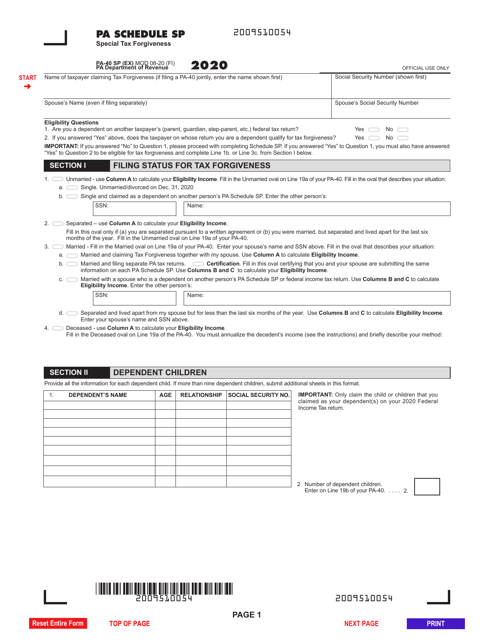

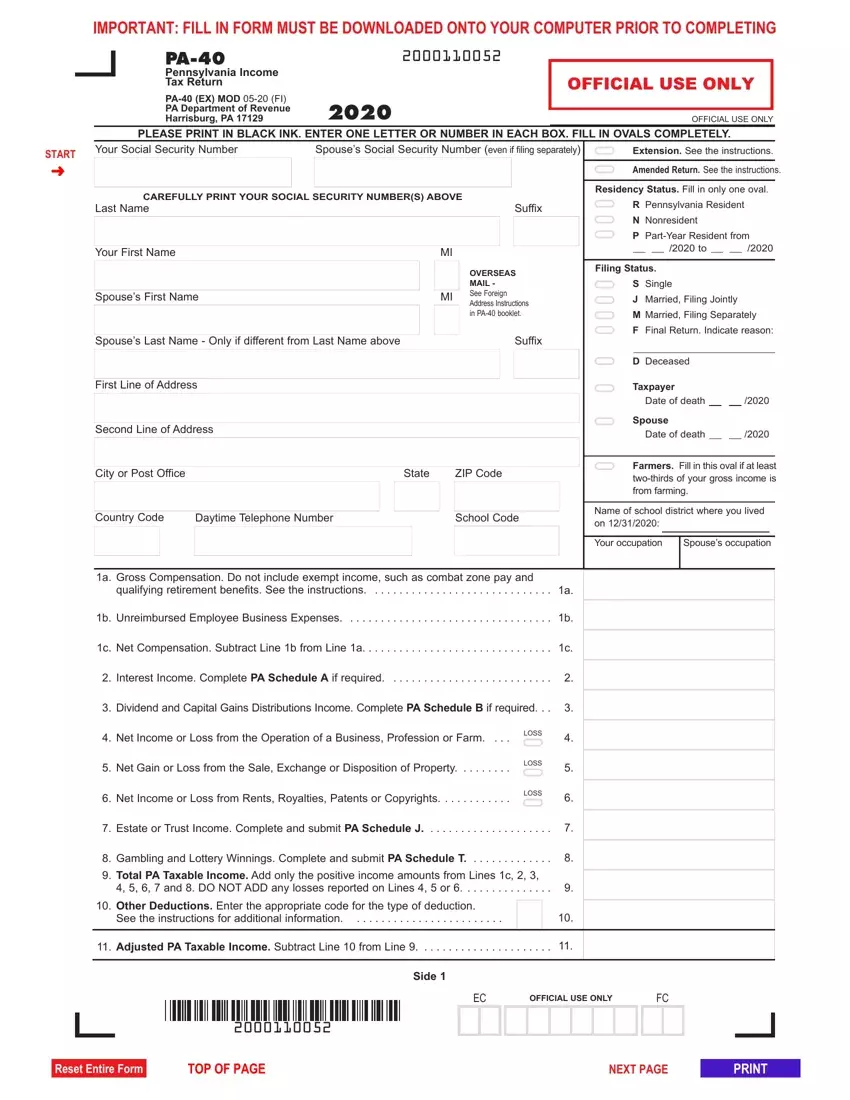

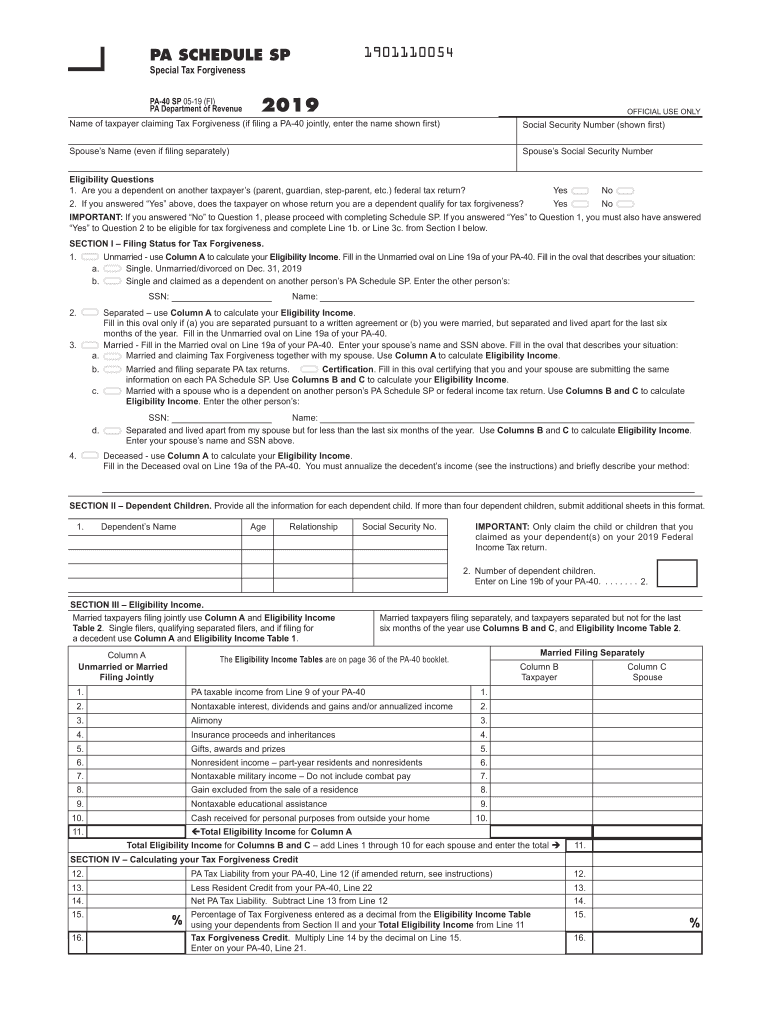

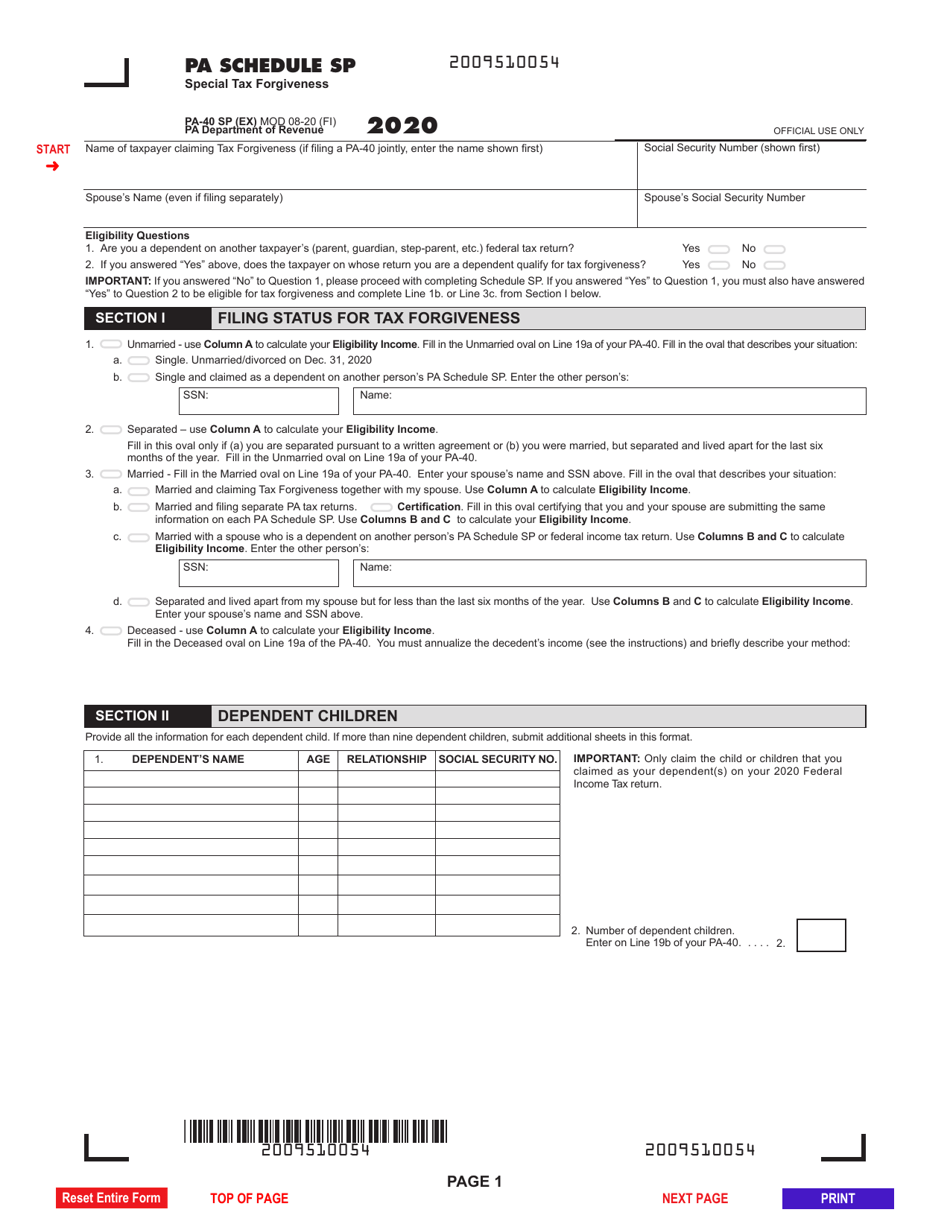

Its for lower-income families and some single filers and is based on your income amount and size. More about the Pennsylvania Form PA-40 SP Individual Income Tax TY 2021 Use PA-40 Schedule SP to claim the Tax Forgiveness Credit for taxpayers who meet the qualifications to reduce all. The Taxpayer Relief Act Act 1 of Special Session 1 of 2006 was signed into law on June 27 2006.

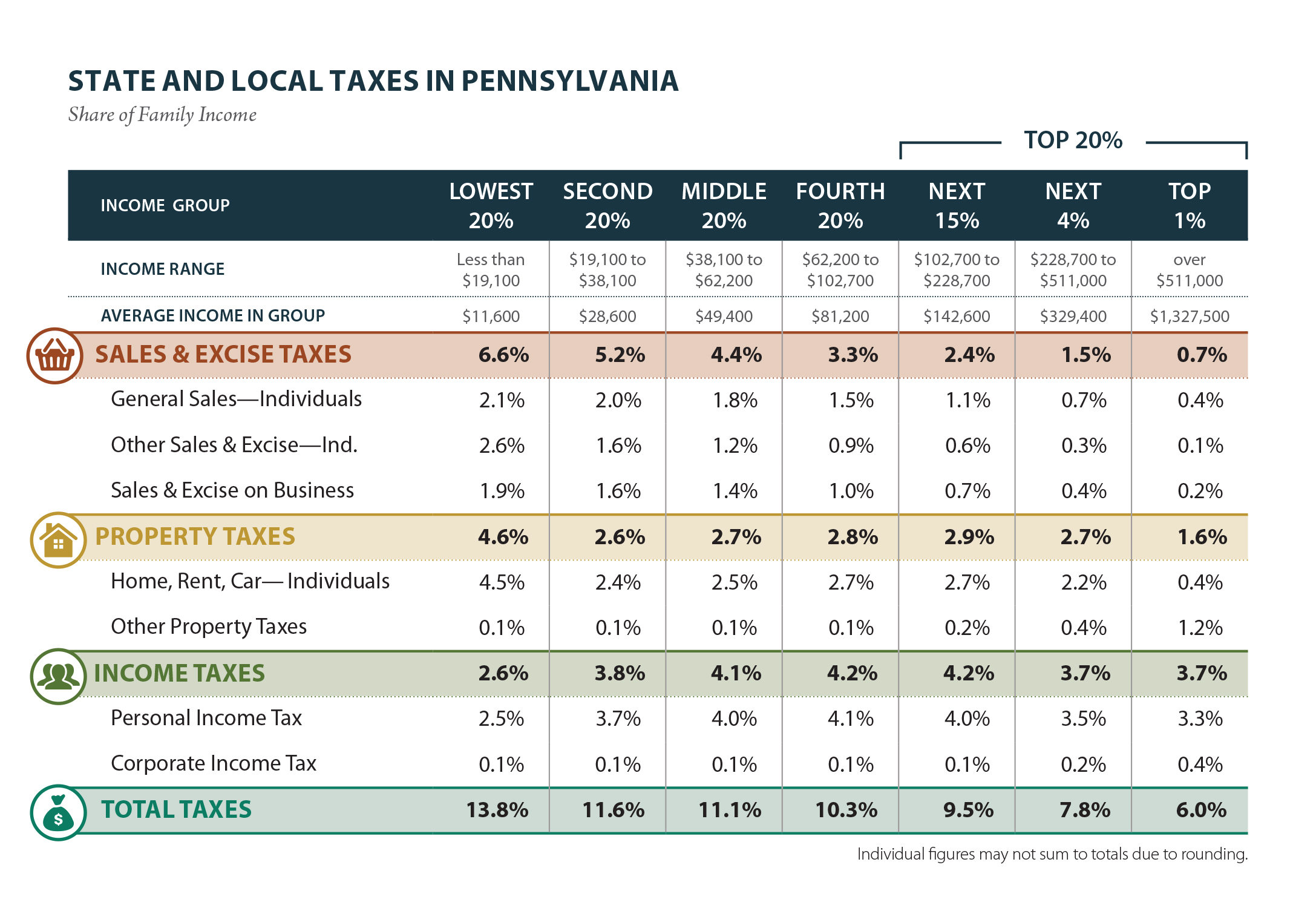

Tax Forgiveness is a credit against PA tax that allows eligible taxpayers to reduce all or part of their PA tax liability. Our Certified Debt Counselors Help You Achieve Financial Freedom. State Tax Forgiveness States also offer tax forgiveness based on personal income standards.

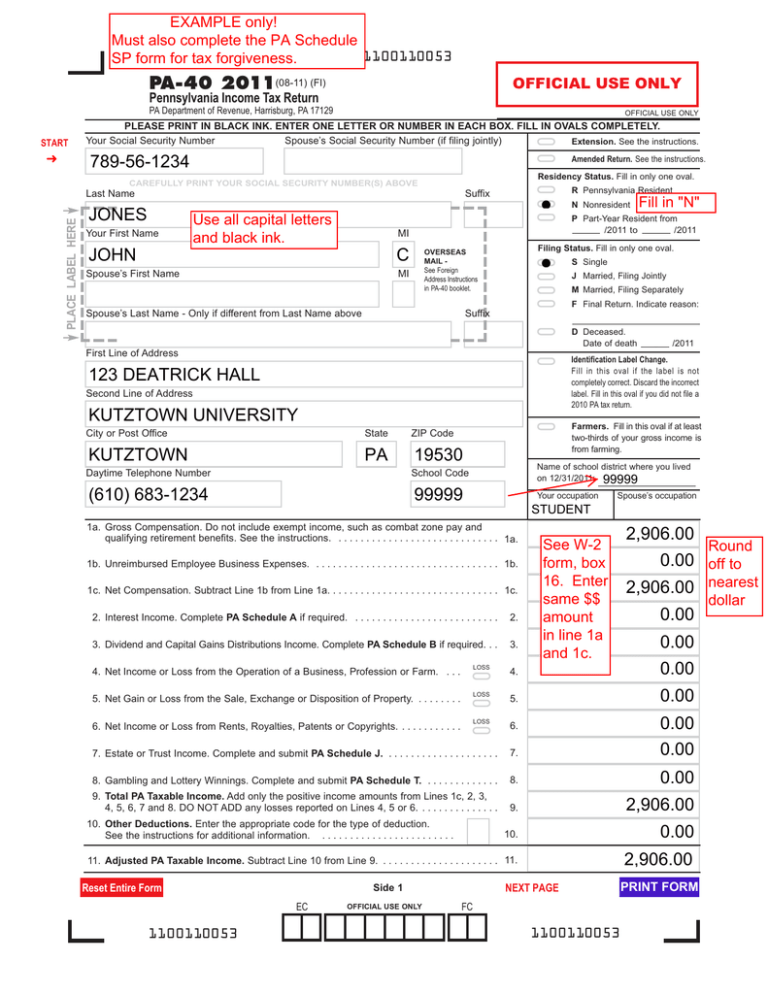

To claim this credit it is necessary that a taxpayer file a PA-40. Record tax paid to other states or countries. Tax forgiveness gives a state tax refund to some taxpayers and forgives some taxpayers of their liabilities even if they havent paid their Pennsylvania income tax.

ELIGIBILITY INCOME TABLE 1. For example in Pennsylvania a single. Alimony- Alimony payments that you received are not taxable in the state of Pennsylvania.

The Pennsylvania Tax Forgiveness Credit is a credit that allows eligible taxpayers to reduce all or part of their tax liability to PA. Harrisburg PA With the personal income tax filing deadline approaching on May 17 2021 the Department of Revenue is reminding low-income. 31 2020 toward a maximum of 10000 of each employees wages with the quarterly.

To enter this credit within. Our Certified Debt Counselors Help You Achieve Financial Freedom. You Dont Have to Face the IRS Alone.

Provides a reduction in tax liability.

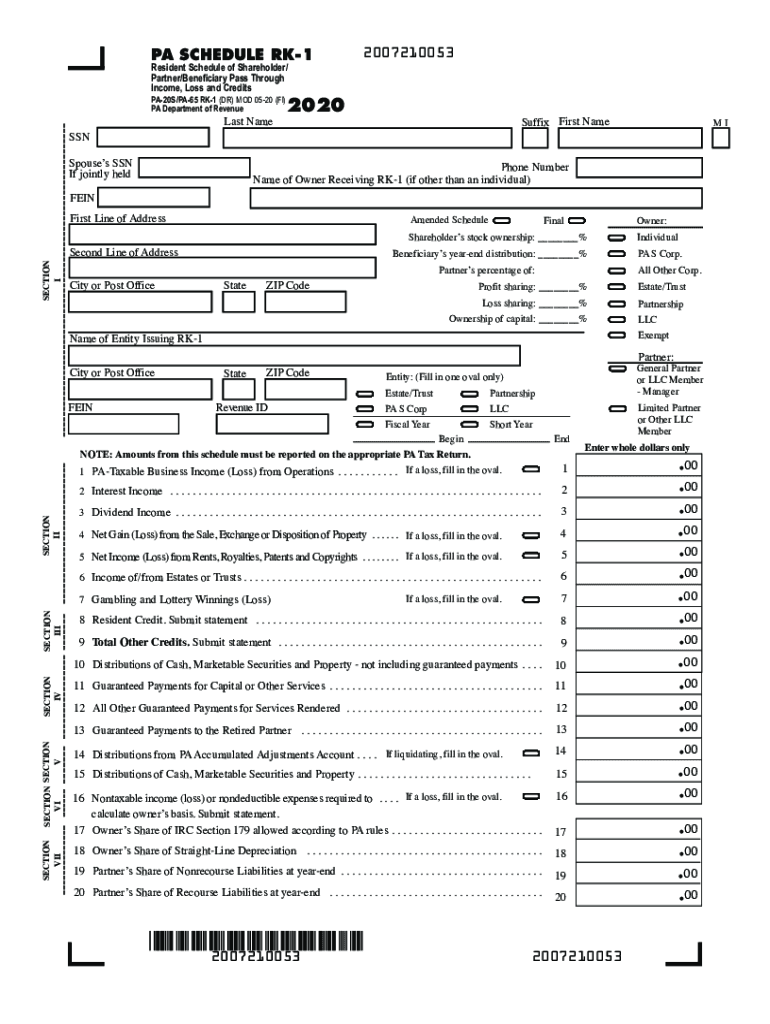

Pa Schedule Rk 1 2020 2022 Fill Out Tax Template Online

Pennsylvania Special Tax Forgiveness Credit Do You Qualify Supermoney

Form Pa 40 Schedule Sp Download Fillable Pdf Or Fill Online Special Tax Forgiveness 2020 Pennsylvania Templateroller

Form Pa 40 Schedule Sp Download Fillable Pdf Or Fill Online Special Tax Forgiveness 2020 Pennsylvania Templateroller

2011 Pa Schedule Sp 1101110052

Form Pa 40sp Pa Schedule Sp Special Tax Forgiveness Pa 40 Sp

Pa 40 Tax Form Fill Out Printable Pdf Forms Online

Form Pa 40 Schedule Sp Download Fillable Pdf Or Fill Online Special Tax Forgiveness 2020 Pennsylvania Templateroller

Pa Dor Pa 40 Sp 2019 2022 Fill Out Tax Template Online Us Legal Forms

Free Form Pa 40 Pennsylvania Income Tax Return Free Legal Forms Laws Com

Form Pa 40 Schedule Sp Download Fillable Pdf Or Fill Online Special Tax Forgiveness 2020 Pennsylvania Templateroller

Low Income Pennsylvanians May Be Missing Out On Pa Tax Refunds Of 100 Or More

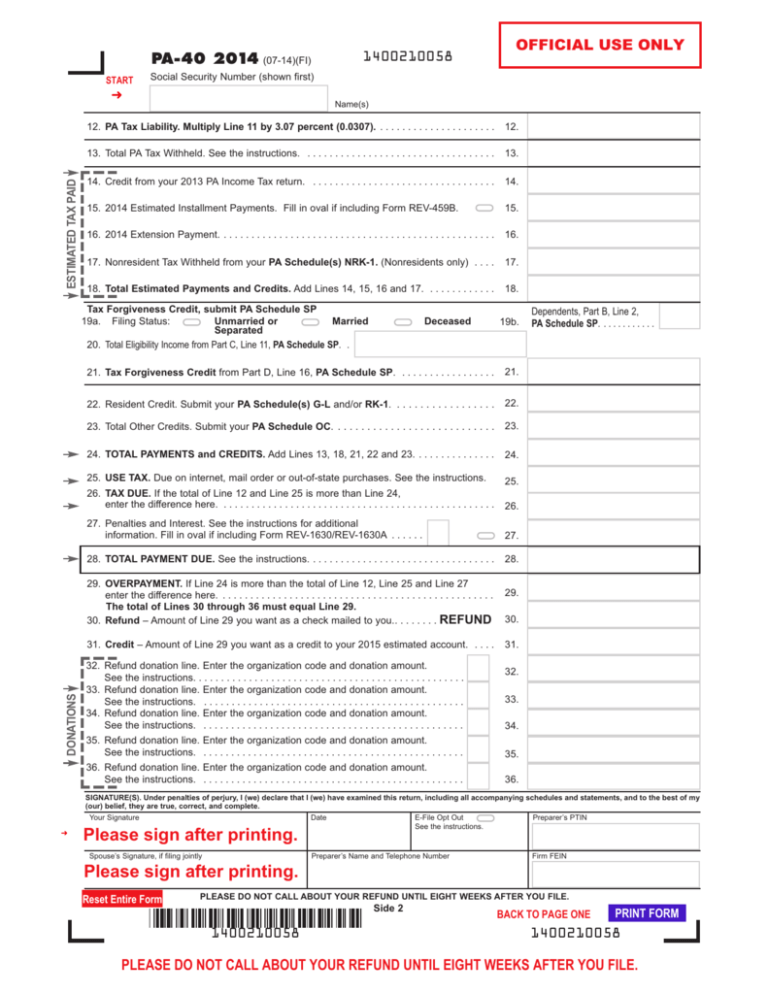

Form Pa 40 Fillable 2014 Pennsylvania Income Tax Return

Form Pa 40 Schedule Sp Download Fillable Pdf Or Fill Online Special Tax Forgiveness 2020 Pennsylvania Templateroller